By Samuel Shen and Summer Zhen

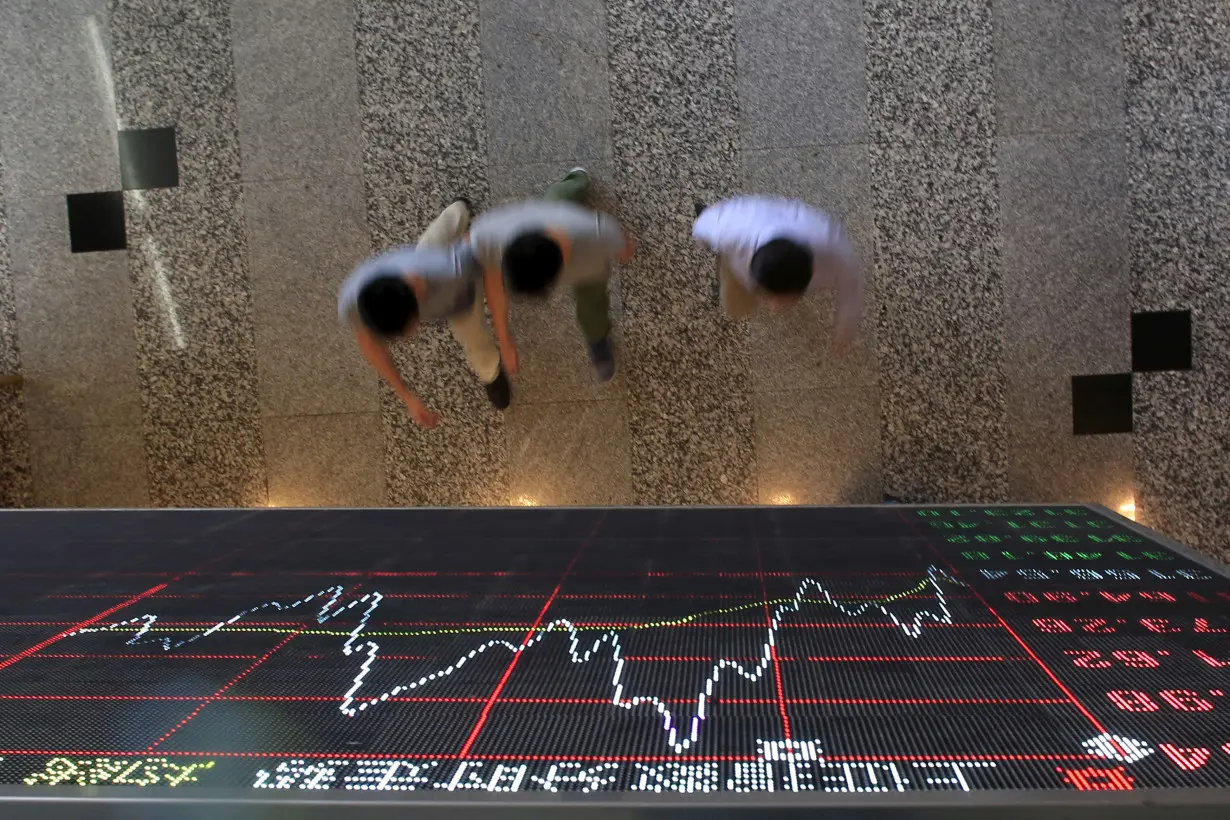

SHANGHAI/HONG KONG (Reuters) - China's data-driven quant trading funds are briskly expanding overseas as competition heats up at home and regulators tighten scrutiny of the $260 billion sector.

Meridian & Saturn Capital (MS Capital), with offices in Shanghai and Singapore, said it is starting to offer its China strategy to offshore investors, and also preparing to invest in global markets.

DH Fund Management set up its first offshore fund in March, according to a public filing, and Beijing-based Ubiquant plans to open a U.S. office, a source familiar with the matter said on condition of anonymity. DH Fund and Ubiquant declined to comment.

Chinese quant hedge funds have been venturing into overseas markets for years, but their expansion has accelerated as the sector has become increasingly crowded at home and regulators tighten their supervision of a sector able to profit from market volatility.

Many Chinese funds want to get exposure to European and U.S. investors, and also need to build offshore structures, as "they cannot just trade China forever," said Alvin Fan, CEO of hedge fund platform OP Investment Management.

Fan and some other fund executives launched the Chinese Overseas Private Funds Association last week in Hong Kong, an industry body to help Chinese fund managers expand globally and collectively voice their concerns to policymakers.

Filippo Shen, the China chief representative of Dutch asset manager Privium Fund Management (HK), said a growing number of funds are not merely raising money overseas, but also investing abroad.

"Under the current compliance rules in China, some quant strategies don't work, or cannot deliver the best performance at home," said Shen, who helps Chinese funds build global brands.

"So some quant funds are setting up their second investment centre, in Hong Kong or Singapore, where their strategies may work better, and operate more freely."

It also means head-to-head competition in offshore markets with global giants such as UK-based quant fund managers Winton and Man Group, and U.S.-based Two Sigma.

CAPTURING 'ALPHA'

Earlier this month, China's securities regulators published draft rules aimed at sharpening the oversight of programme and high-frequency trading.

Kate Zhang, partner and CEO of MS Capital, said China's massive and relatively volatile market gives quant funds an edge, by allowing them to generate 'alpha' or market outperformance. Quant funds primarily use programme trading, where computer models place orders automatically and rapidly capture tiny market fluctuations.

MS Capital offers investors a China-focused market-neutral strategy. It aims to expand investment beyond China and roll out global strategies later this year, initially targeting Asian markets such as Japan, India and Thailand, before eventually making a foray into European and U.S. markets.

Shanghai-based Minghong Investment also has tall global ambitions, preparing strategies targeting Japan and India, having already used its own money to test waters in the U.S. and South Korea.

Privium's Shen said he is getting more queries from Chinese fund managers about launching global strategies, and is in talks with a major Chinese fund seeking to build a global brand.

(This story has been corrected to fix the company name to Minghong in paragraph 14)

(Reporting by Samuel Shen and Summer Zhen; Editing by Vidya Ranganathan and Jacqueline Wong)